Bitcoin is a Financial Asset—Here’s Why the Tech Crash Doesn’t Matter

On the Contrary: Here’s Why the Tech Crash Could Be Bullish for Bitcoin

If you no longer wish to receive our email reports, please click the unsubscribe link below (at the bottom).

👇1-12) Yesterday’s Market Update report, titled “Bitcoin Breakout Imminent? Here’s Why the Risk is to the Upside,” may have been either ill-timed or perfectly timed, as the recent downside volatility could offer a compelling opportunity to accumulate more Bitcoin. As always, our reports are grounded in data, and we’re providing a fresh perspective to help contextualize yesterday’s market decline.

👇2-12) We anticipated some volatility, with several major U.S. tech companies reporting this week. Investors are increasingly scrutinizing large capital expenditure plans, particularly as many AI systems lack clear guidance on potential profit generation. NVIDIA’s stock has moved sideways since June last year, and Apple’s highly anticipated AI upgrade cycle has been “just around the corner” for years. Meanwhile, inflation appears to be holding steady for now.

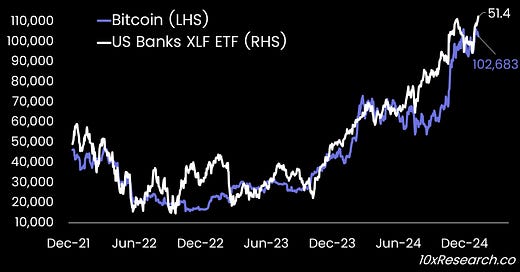

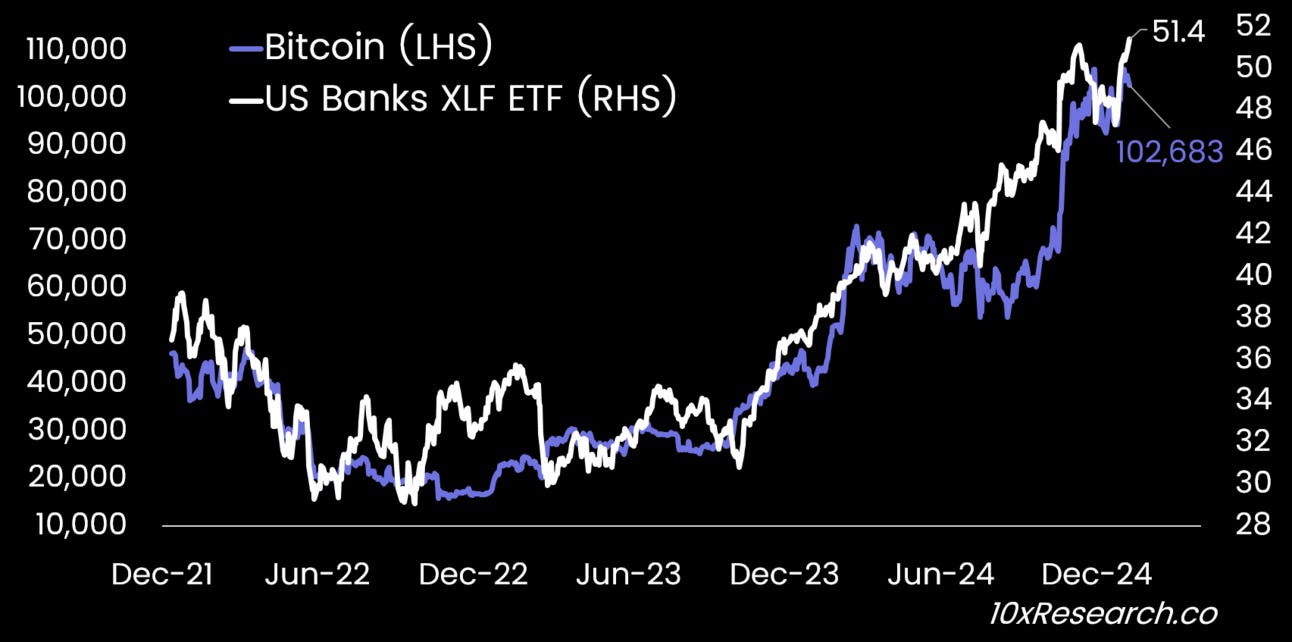

Bitcoin (LHS) vs. US Banks XLF ETF (RHS)

👇3-12) The new U.S. president’s focus on the domestic economy signals a shift from tech as the favored sector to financials emerging as a better play. This shift is further reflected in the stronger U.S. dollar, which benefits domestically focused-companies over export-driven tech firms with significant overseas earnings. Reducing AI spending keeps share buybacks as a key driver of U.S. equity returns and eases inflationary pressures, addressing the Fed’s concerns and making them marginally less hawkish.