Bitcoin ETFs and OGs Offload $1 Billion Each - Should You Sell Too?

Institutional Crypto Research Written by Experts

👇1-15) The 4-year predictable, parabolic cycle pattern, which forms the basis of 95% of crypto forecasts, is a significant factor in Bitcoin's price projections. This pattern, often extrapolated, suggests that Bitcoin's value will continue to rise indefinitely. The stock-to-flow model, another key tool, factors in the diminishing supply to project an infinite value. This year, as in the past, most experts anticipate Bitcoin to reach new heights, with predictions ranging from 100,000 to 150,000 or even higher.

👇2-15) Technological innovation and human psychology, particularly the interplay of greed and fear, are pivotal catalysts in the cyclical cryptocurrency market. Despite this, the market fundamentally operates as a momentum game, with most participants actively driving prices higher and maintaining a consistently bullish stance. This self-fulfilling prophecy underscores the necessity to seize upside momentum when opportunities arise assertively. This also elucidates the likelihood of many more cycles in the future.

👇3-15) Bitcoin's utility value and its valuation on a cash flow basis should be addressed in discussions; unlike other assets, it is similar to Gold, which is valued based on a production cost curve. Over time, the psychological aspect of purchasing Bitcoin has become more complex, as the high price of one coin (70,000) is less appealing than the affordability of a billion coins for 100 dollars. Meme coins exploit this psychology, while companies use stock splits for the same reason.

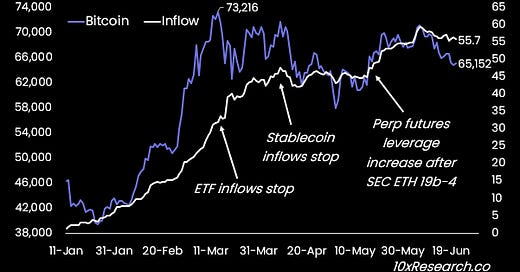

Bitcoin (purple) vs. our money flow indicator (purple)