Bitcoin ETF Options Launch Today – Could This Be a Game-Changer for BTC?

With the introduction of options on IBIT, open interest could surpass $50 billion...

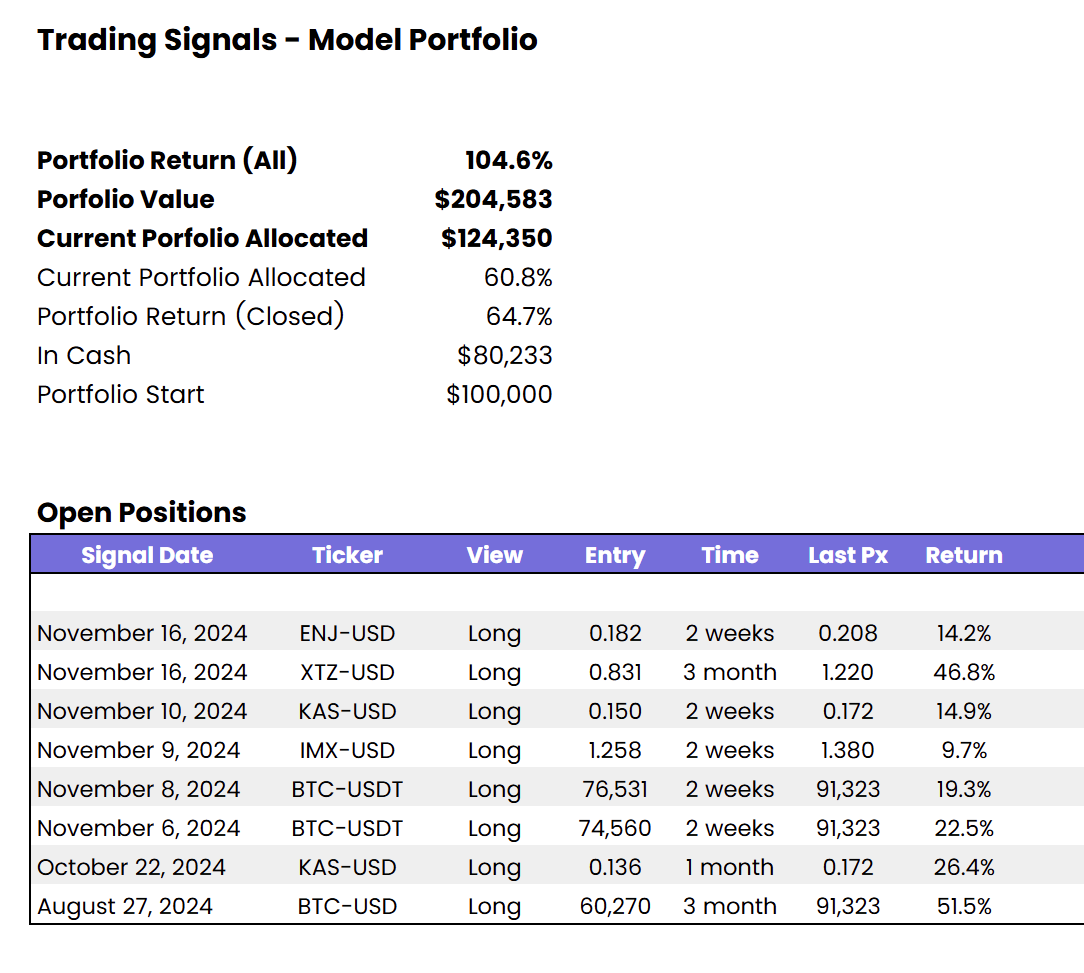

👇1-16) The crypto market has surged in pace over the past two weeks, with our Trading Signals model portfolio achieving over +100% returns for the first time in 2024. Several earlier trades will be closed this week as they reach their predetermined trade horizons, but this doesn’t indicate a shift to a bearish outlook. On the contrary, recently added trades like ENJ and XTZ, introduced on Sunday, are already up +14.2% and +46.8%, respectively.

10x Research ‘Trading Signals Model Portfolio’

👇2-16) For ‘Market Update’ subscribers interested in upgrading to ‘Trading Signals,’ you can do so here. (We often receive this question, so we wanted to address it directly.) If you’re not yet a subscriber, you can sign up here.

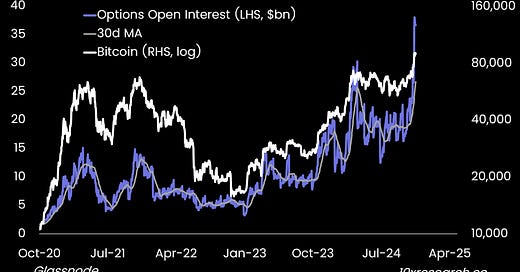

👇3-16) The three key hurdles for listing options on Bitcoin Spot ETFs have now been cleared. The SEC approved the listing and trading of the iShares Bitcoin Trust (IBIT) on September 20, 2024, followed by the CFTC’s approval on November 15, and the OCC’s final clearance last night. Options trading is expected to commence on Tuesday, November 19, 2024.

👇4-16) This marks a monumental shift, as CME options on Bitcoin futures have historically struggled with low volumes and high margin requirements, and Deribit operates in a jurisdiction that restricts access for many U.S.-based funds, besides exposing traders to counterparty risk without the protection of the OCC. Consequently, options on IBIT and other Bitcoin Spot ETFs could attract significant trading volumes, potentially driving sharp price rallies in Bitcoin. There are important implications for Bitcoin traders as prices could see significant impact from these options.

Bitcoin Options Open Interest (LHS, $bn) vs. Bitcoin (RHS, log chart)