Bitcoin Crash or Pause? Here’s Why BTC is Falling and When It’ll Bounce Back!

However, this appears to be....

👇1-15) Gold's strong performance over the past year has been driven by global central banks diversifying away from the U.S. dollar and its role as a safeguard for U.S. consumers' purchasing power amid sharply rising debt levels. Like gold, Bitcoin has become a critical monetary hedge. Over the past decade, the near doubling of the global money supply has fueled price increases across goods and services.

👇2-15) Governments facing demographic challenges issue increasing debt levels to sustain their economies and offset lower labor participation rates. Since most debt rolls over every four years, a cyclical pattern emerges where assets trough and peak, aligning with the U.S. presidential and Bitcoin halving cycles. Historically, assets climb gradually ("taking the stairs up") but experience sharper declines ("taking the elevator down"), resulting in a predictable pattern: three years of positive returns followed by one year of negative returns.

👇3-15) This pattern has consistently played out during Bitcoin's short history, pointing to a continued bullish outlook for 2025. Historically, the strongest returns often occur in the later stages of the cycle, reinforcing the case for another strong year ahead. Some refer to this accelerated fiscal and monetary support period as the "Banana Zone." However, with the incoming Trump administration, there is increasing discussion about reducing the budget deficit and cutting government spending. Such measures could slow the pace of monetary debasement, a key factor traditionally serving as a strong tailwind for Bitcoin.

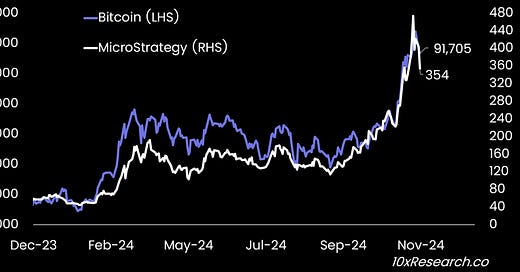

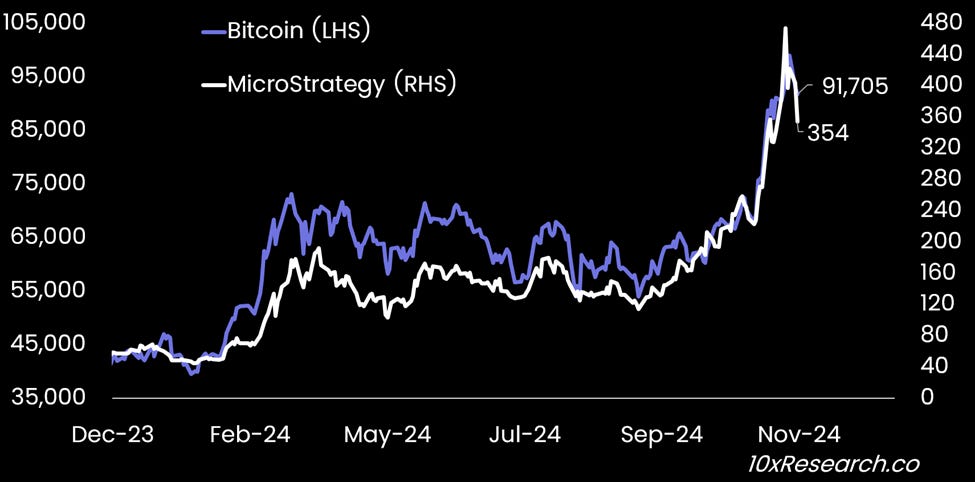

Bitcoin (RHS) vs. MicroStrategy (RHS)