Bitcoin Bottom Forming? Fed Eases, Trump Softens Tariffs, Altcoins Break Out?

Institutional Crypto Research Written by Experts

Join us for an exclusive event for 10x Research subscribers during Token 2049 Dubai. The Dubai Skyline Soirée will be held at Ora Club Dubai on Wednesday, April 30, starting at 9 PM and going late into the night (here).

Bitcoin Bottom Forming? Fed Eases, Trump Softens Tariffs, Altcoins Break Out?

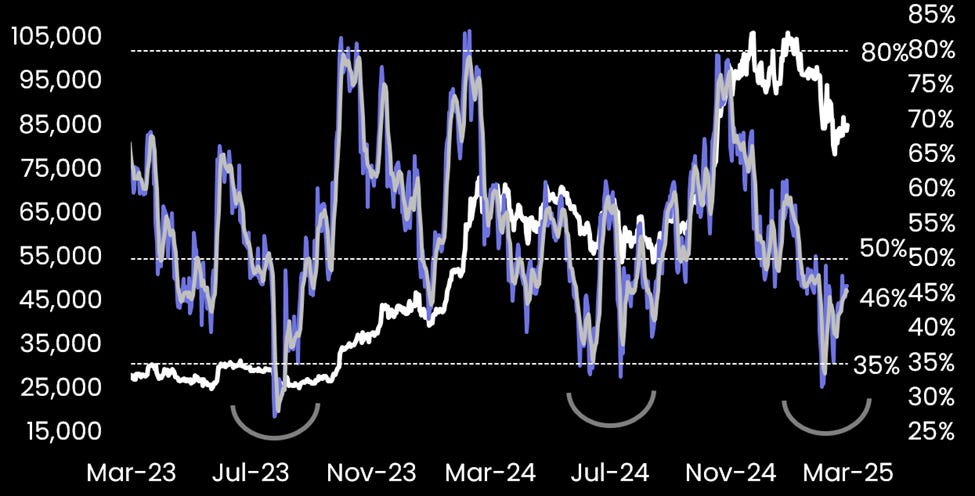

👇1-13) We anticipated a deeper correction after Bitcoin broke below $95,000, confirming the breakdown from its ascending broadening wedge. However, over the past week, we’ve adopted a more constructive outlook as increasing technical indicators have begun aligning with a potential recovery.

👇2-13) As we highlighted in our March 15 report, Bitcoin is attempting to form a bottom, supported by Trump’s recent shift toward “flexibility” on the upcoming April 2 reciprocal tariffs, softening his earlier rhetoric. Our March 17 report also noted a mildly more constructive outlook following a CPI release that helped ease inflation concerns. The FOMC meeting unfolded in line with our expectations, as the Fed signaled it might look past short-term inflationary pressures, laying the groundwork for potential future easing—precisely as we had anticipated.

Bitcoin - bottoming formations

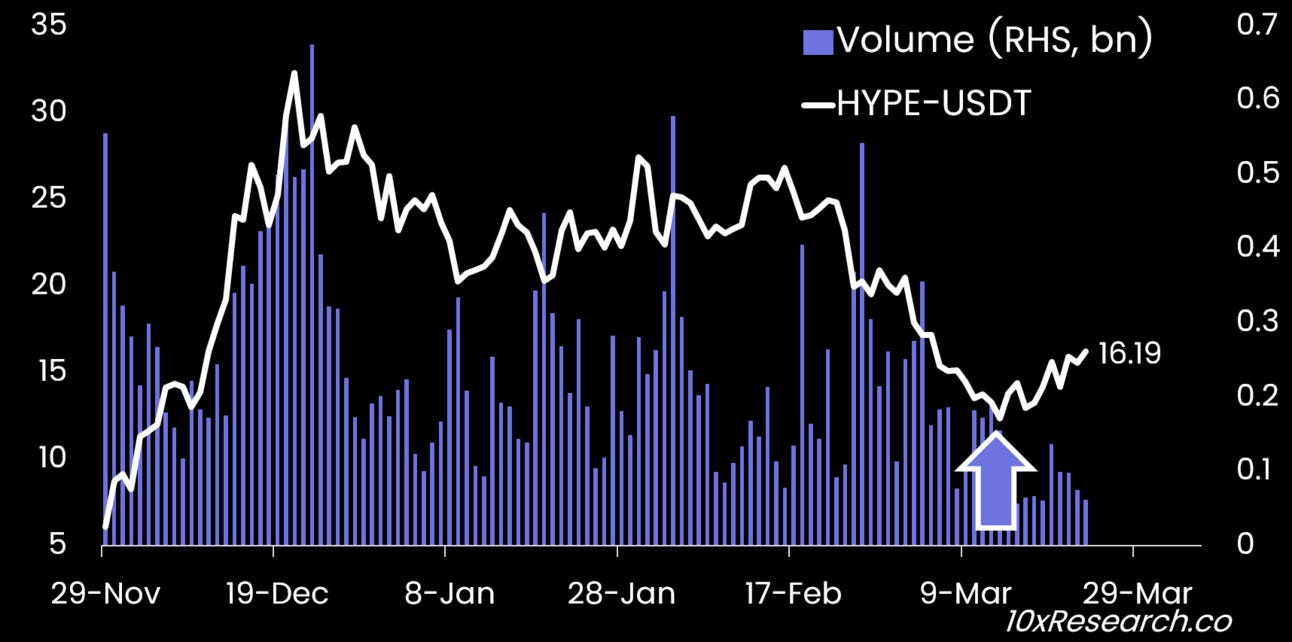

👇3-13) Since our March 17 report, “HYPE Reloaded: Is the Dip a New Entry Point?”, Hyperliquid’s HYPE token has climbed +21%, proving that selective opportunities still exist despite overall trading volumes slipping into a typical summer lull as the market awaits its next catalyst. This mirrors the sentiment we observed in September 2024, when traders grew indifferent, but our models correctly identified an impending breakout by closely tracking market dynamics.

HYPE is already +21% in just a few days… some altcoins are attractive

👇4-13) When managing capital for Millennium and other hedge funds, we always allocated part of the portfolio to systematic strategies, as disciplined, model-driven processes consistently alerted us to trend shifts. Even in quieter markets like today, such an approach helps uncover early signals, and we see several emerging developments that could act as meaningful catalysts in the coming months.