Bitcoin and the Santa Claus Rally: 45,000 possible?

Institutional Crypto Research Written by Experts

In October, Bitcoin surged by +28%, elevating its year-to-date growth by +108%, which surprised market participants and commentators. However, it was no surprise to our readers.

On September 20, we published a report forecasting the institutional support driving the Bitcoin price surge, harnessing our 90% probability breakout signal. This signal indicated that Bitcoin was poised for a breakthrough after two months of trading sideways.

Based on our historical analysis, the Bitcoin bull market is expected to continue. Bitcoin tends to be a solid trending asset because high prices attract more traders to jump on the price move. This, in turn, causes prices to rise even further.

For example, when Bitcoin is up by at least +50% by the end of October, there is, on average, a 78% chance that Bitcoin will advance even more into year-end. Bitcoin rallied, on average, another +68% until year-end on seven of nine previous occasions. This analysis is based on thirteen years of Bitcoin history.

If Bitcoin is up at least +100% by this time of the year, then there is a +71% chance or five in seven that Bitcoin would finish the year higher with average year-end rallies of +65%.

As Bitcoin tends to reach its peak by December 18, we could call the six to seven weeks from early November to mid-December ‘Bitcoin’s Santa Claus Rally.’ The only two occasions when Bitcoin declined into year-end, despite being up +100% by the end of October, were 2021 and 2019, when Bitcoin fell by -26% and -24%, respectively.

During the last 9-10 years, the average return has been ~+200% for Bitcoin with prices rising +86% by the end of October only then to see an acceleration into year-end. This year could prove to be quite similar to the historical average.

Some traders anticipate that the SEC aims to conclude the BlackRock (and other issuers) Bitcoin ETF applications by Christmas, which could keep the momentum elevated. The next round of SEC responses is expected by mid-January 2024, and it is highly unlikely that the SEC would signal any negative news before those deadlines.

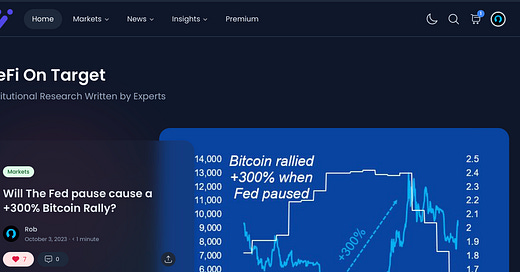

This week’s FOMC meeting would also support a strong risk-on rally, including stocks and crypto, into year-end. While the Fed kept interest rates on hold as expected, the market is now pricing in rate cuts for June 2024.

During the post meeting press conference, Fed Chair Powell pointed out that the public believes inflation will come down and this is important from an inflation anchoring perspective in our view. He also said that ‘risk on inflation now have become more two-sided’ — this is a clear interpretation that there could be downside risk to inflation.