Bitcoin & Ethereum Soar as Short Cover Rally Gains Momentum Ahead of Crucial CPI Data Release

Institutional Crypto Research Written by Experts

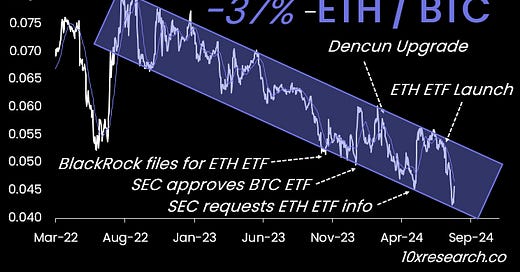

👇1-12) The Ethereum/Bitcoin ratio has dropped by 37% since the Ethereum Merge on September 15, 2022, marking the onset of a sharp downtrend. The ratio has repeatedly faced resistance at the upper boundary of the descending channel and found support near its lower edge. In anticipation of this week's US CPI data, we are observing a rebound in the ratio, likely driven by short covering.

Ethereum / Bitcoin Ratio - a steep -37% decline since the Merge

👇2-12) While Ethereum developers continue to advance scaling solutions—mainly focusing on rollups that aggregate transactions to boost efficiency and target 100,000 transactions per second—significant efforts are also being made to enhance user experience and network efficiency. Account abstraction is set to introduce smart contract wallets, making the platform more user-friendly and reducing transaction costs. Additionally, implementing single-slot finality will dramatically accelerate block finalization, improving the network's performance.

👇3-12) Previous upgrades, such as the Merge and Dencun, have had minimal impact on Ether's price. Instead, Ethereum's value continues to be primarily driven by macroeconomic factors like inflation.