Bitcoin $100K Within Reach, But Clouds Loom Ahead...With Implied Volatility gapping higher

Long Bitcoin vs. Short .....

👇1-14) Bitcoin’s dominance has surged above 60%, with altcoins, particularly Ethereum, continuing to lag in this rally. A key driver behind Bitcoin’s momentum is the relentless rally in MicroStrategy shares, fueled by two crucial factors. In anticipation of the expected Q4 Bitcoin breakout, we introduced the concept that MicroStrategy’s rising share price could have a "tail wags the dog" effect on Bitcoin’s price (here). This dynamic stems from MicroStrategy’s strategy of consistently upsizing capital raises through debt offerings, pushing Bitcoin prices higher as these funds are used to accumulate Bitcoin.

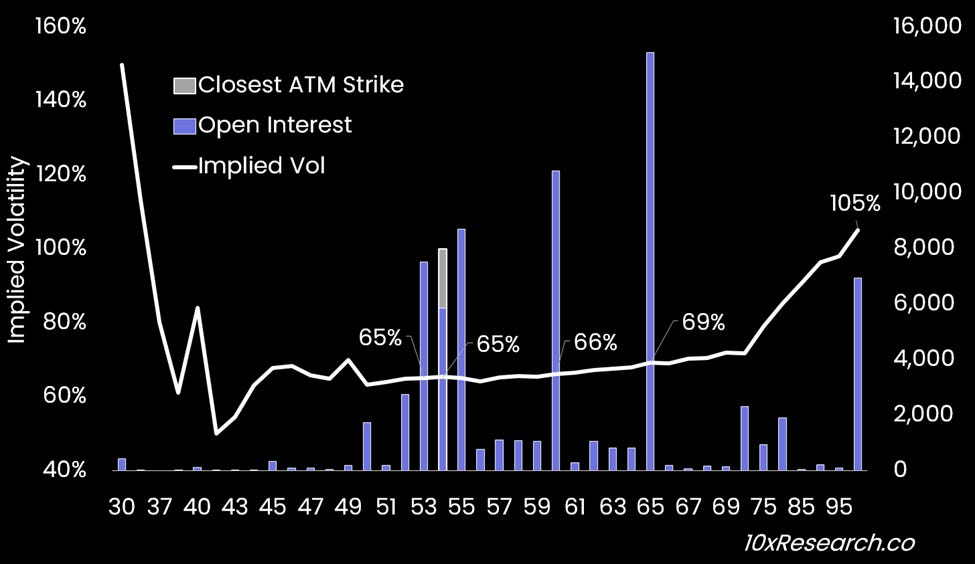

Distribution of call options on Bitcoin IBIT ETF & implied vol levels per strike

👇2-14) Viewed through this lens, MicroStrategy’s valuation should not be directly compared to Bitcoin’s price. Bitcoin itself is not the liability associated with these capital raises. Instead, the liability is tied to treasury yields, convertible debt, or even the broader US dollar pool—assets that MicroStrategy effectively borrows to acquire Bitcoin. This distinction highlights a unique relationship between the company and its growing Bitcoin treasury.