Are Smart Traders Hedging Bitcoin with Altcoin Shorts?

From a trading perspective, the best approach is to follow...

10x Research is an official Consensus Hong Kong Partner and we will be attending the Consensus in Hong Kong! If you'd like to connect during the event, please reach out—we may also organize a special gathering. Additionally, our offer lets attendees enjoy an exclusive 15% discount on tickets.

How to Redeem Your Discount:

Visit the link: https://go.coindesk.com/10xresearch

Add your desired tickets to the cart.

Enter the promo code 10XRESEARCH15 at checkout to apply the discount.

We look forward to seeing you there!

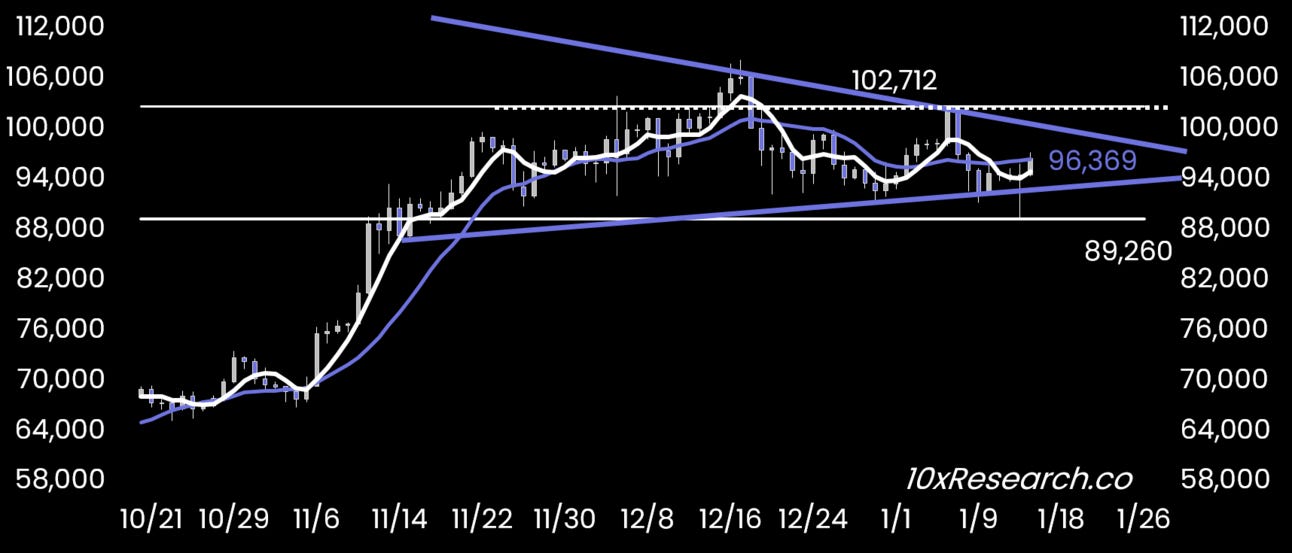

👇1-12) Bitcoin continues to trade within a narrowing wedge, with several critical catalysts on the horizon. Expectations for a higher CPI number have risen, creating a scenario where a softer-than-expected inflation reading could trigger a Bitcoin rally. This aligns with our January outlook, which anticipated a moderately positive start to the month, followed by an inflation scare leading up to the CPI release.

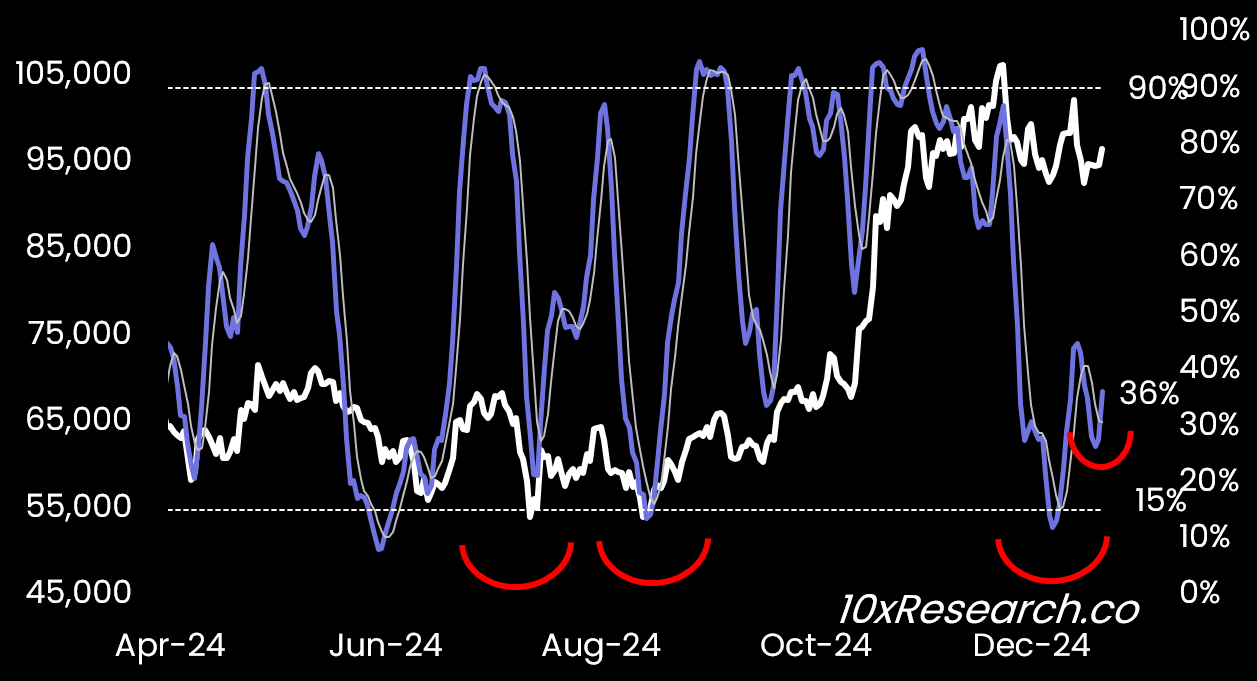

👇2-12) The risk-reward ratio at this point is not particularly favorable, with downside risks persisting. While Bitcoin has shown resilience, much of the altcoin market is experiencing significant declines.

👇3-12) The inflation scare materialized, driven by the ISM Non-Manufacturing Services Prices Index and stronger-than-expected US employment data. Bitcoin rebounded two days before the CPI release on January 15. Ideally, a deeper pullback (sub-$90,000) ahead of the data would have presented a more attractive setup for a rebound, potentially coinciding with Trump's inauguration on January 20, as outlined in our projected January roadmap.

👇4-12) With Bitcoin trading near $96,000, the risk/reward appears more evenly balanced. The Federal Reserve meeting on January 29 will be pivotal, and the market will likely trade cautiously in the days leading up to this event.

Bitcoin is trading into a narrowing wedge

👇5-12) Our outlook remains cautious as Trump’s term begins. Due to weak market drivers, Bitcoin will likely remain range-bound until mid-March. However, Bitcoin trades within a narrowing triangle, signaling a breakout is imminent—likely no later than the January 29 FOMC meeting.

👇6-12) From a trading perspective, the best approach is to follow the breakout, regardless of direction. While arguments exist for both upward and downward moves, the market will ultimately dictate the outcome. Irrespective of the direction, risk management is critical. With the current environment less supportive than in late September, traders should maintain smaller positions and use limited leverage to navigate this uncertainty.

Bitcoin: Daily Stochastics Indicator rebounding from oversold levels