A new trading alert for Bitcoin ETFs has been triggered

Institutional Crypto Research Written by Experts

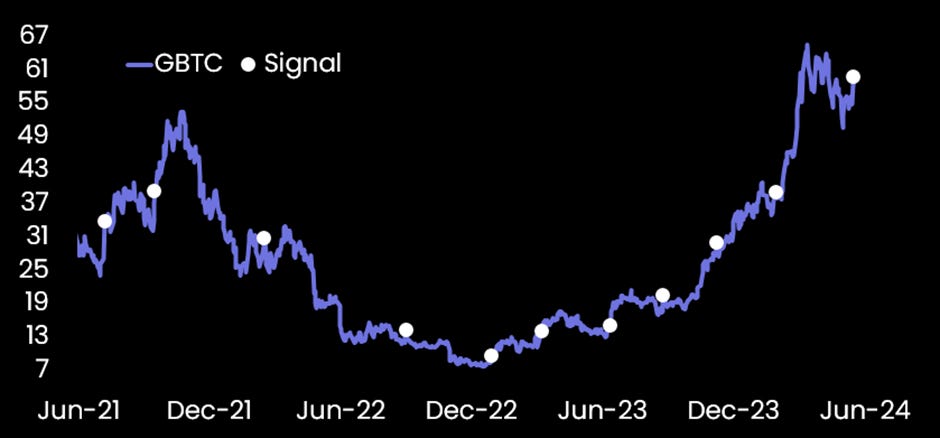

👇1-10) A new trading alert for Bitcoin ETFs has been triggered. Many have asked us to run our trading signals for crypto-related stocks, such as Bitcoin miners, and diversified crypto stocks, such as Coinbase. Not every trading signal will be successful, but generally, with a 70-80% probability, they provide us with timely reminders when a dull trading range might end. The last time this model was triggered was on January 30, 2024.

👇2-10) While Grayscale’s GBTC is correlated to the price of Bitcoin during US trading hours, it has enough history to run this converted ETF through our model—hence, trading signals for GBTC should also work for the newer ETFs (such as Blackrock’s IBIT). This could give institutional investors and us a clue as to where the price of Bitcoin might be going.

Previous BTC ETF Trading Signals - Would You Buy Now?

👇3-10) There is no coincidence that Bitcoin ETF inflows stopped on March 12 (see our previous reports), and there might also be no coincidence that those Bitcoin ETF flows are now coming back. This could have profound implications for Bitcoin prices and result in much higher prices in the months ahead.