A killer statistic for Bitcoin -> targets 45,000

Helping EVERYONE to make better crypto investment decisions.

🚩 In 10 bullet points:

🌎 Telegram updates... https://lnkd.in/gqMMgw5Z

👇 1) We, nor our readers, are surprised that Bitcoin prices rallied by +38% in January – and there is very likely more returns to come, here is why:

👇 2) In our 2023 outlook report, we pointed out how the macro picture had turned outright bullish for risk assets, including crypto.

👇 3) Our analysis from January 5 indicated that Ethereum prices could rally by +27% into the March Shanghai upgrade. That report was based on some numbers we ran and indeed Ethereum quickly achieved the 1,600 price target.

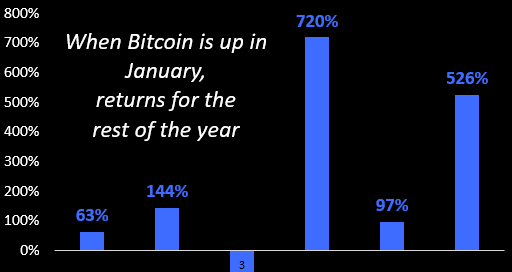

Exhibit 1: When January is up, Bitcoin returns for the rest of the year

👇 4) By January 20, we sent out our Bitcoin Chinese New Year analysis that predicted a +9% rally within just ten days. A Twitter tweet got 240,000 views pointing this out and Bitcoin prices indeed rallied by +10% very quickly.

👇 5) Our analysis around institutional flows showed that indeed US institutions might have been behind the January rally in Bitcoin prices, which tends to be bullish for prices going forward.

👇 6) Here is our new study:

👇 7) When Bitcoin prices are up in January, as has happened six times, then the return for the remaining year (Feb – Dec) has averaged +245% with five out of those six years (83%) showing positive returns.

👇 8) The only year that Bitcoin prices declined after the January effect signal got triggered, was in 2014 when prices just made a bull market peak. This is obviously far from today’s set up after Bitcoin prices declined by -67% from their 2021 peak.

👇 9) The driver of the 2023 bull market could easily be the expected March 2024 Bitcoin halving cycle, which has tended to be very bullish for crypto prices.

👇 10) Hence, there is a high statistical probability that Bitcoin prices could double from here until year end. This could bring Bitcoin prices to 45,000 by Christmas 2023.