99% of Bitcoin / Crypto Traders Do NOT KNOW THIS

Institutional Crypto Research Written by Experts

👇1-14) Many believe Bitcoin's price follows a predictable four-year cycle driven by its halving event, expecting a steady price rise as if on a schedule. Yet, unlike the predictable change of seasons, Bitcoin’s market behavior is far more volatile, often skyrocketing into rapid, parabolic gains when demand shifts suddenly.

👇2-14) Though supply (halving) is often perceived as the primary driver, Bitcoin's price movements are fundamentally demand-driven. Contrary to the perception of irrational or uninformed trading, Bitcoin frequently reflects deeper market fundamentals. Only a few investors understand these intricacies, but the "whales" — major market players with significant influence — are well-acquainted with these factors and shape their strategies around them.

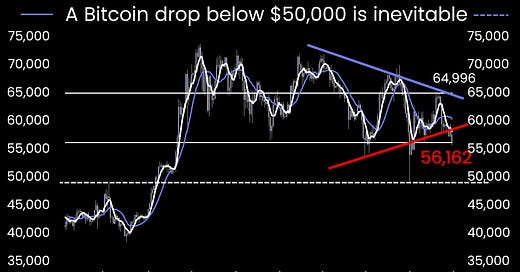

👇3-14) A single metric does not define fundamentals; it combines various data points determining whether Bitcoin and other token prices rise or fall. Since March and April, certain data points have shifted (see our webinar from May), prompting well-informed investors to adjust their portfolios accordingly. While retail traders and memecoin enthusiasts have been loudly pushing for higher prices, these shifting fundamentals signaled to larger investors that it was time to reposition. This change in demand is now influencing Bitcoin's price movement.

👇4-14) Monitoring and analyzing these data points requires far more effort than simply following a motivating tweet, but it distinguishes professionals from amateurs. When market activity slows due to weaker demand, revenue drops, and profits decline. When Ethereum’s revenues sharply decreased in April and May, we cautioned that Ether was overvalued, and prices have since undergone a significant correction.