$5 Trillion AUM Investment Advisors Contemplate 10% Bitcoin Allocation 💥

Helping EVERYONE to make better crypto investment decisions.

Many have been asking, so for the next 30 days, for new yearly subscribers of our substack updates, we will send a signed copy of the book ‘Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets” to their postal address (no extra shipping and handling fees).

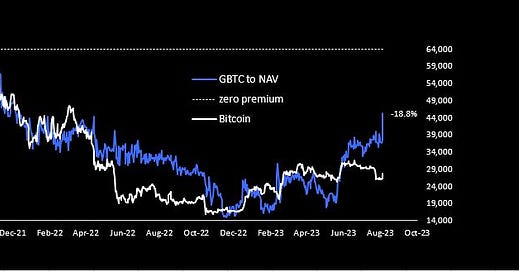

👇 1) The market is pricing in a roughly 75% chance that a Grayscale Bitcoin Trust (GBTC) will receive the SEC approval for an ETF conversion. The net-asset-value discount narrowed from -45% end of 2022 to just -19%. Last night, the appointed judge to the Grayscale – SEC lawsuit clarified that the SEC has to look again at this case. This is not the same as providing a binding legal approval of an ETF but it brings it a big step closer.

👇 2) Over the next few days, there will be more Bitcoin ETF announcements but whatever the outcome, a potential approval will support Bitcoin prices. This is why we expected Bitcoin prices to remain above the $25,000 level when the Blackrock application was filed. We also encouraged our institutional investors to accumulate Bitcoin sub-$26,000 (see the report from last week and yesterday’s report).