🏆 10x Research - Round Up: Bitcoin consolidation ahead, Coindesk video, Bitdeer

Institutional Crypto Research Written by Experts

ON OUR RADAR

👇 1) Binance founder CZ must stay in the US until February 2024, sentencing a judge’s order. The SEC might also file their case against Binance and CZ before February. Terra Luna founder Do Kwon is to be extradited to the US.

👇 2) US Bitcoin ETF issuer talks with the SEC have advanced to critical technical details, in a sign that the agency may soon approve the products

“I think that the future of currency is digital, and Bitcoin has a good shot at being the currency of the future.”

Adam Draper

Quick views:

Bitcoin is anticipated to maintain a consolidation pattern, hovering between the $40,000 and $45,000 range throughout the year. Despite frequent updates on S-1 filings, the Securities and Exchange Commission (SEC) has yet to publicly indicate a likely approval.

The key to a significant upside move in Bitcoin could have involved non-farm payrolls dropping below 100,000 - which did not occur on Friday. The upcoming critical events include the release of the Consumer Price Index (CPI) on December 12 and the Federal Open Market Committee (FOMC) meeting on December 13.

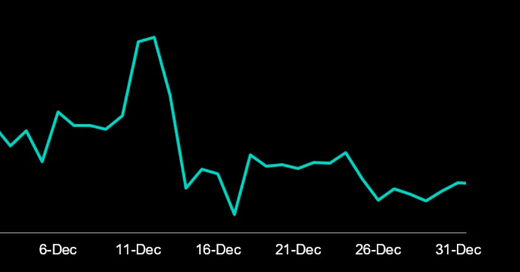

Exhibit 1: Last year, Bitcoin sold off from mid-December and stayed flat

To position for potential upside resulting from a post-December SEC approval of a Bitcoin Spot ETF, a recommended strategy is to sell a call with a strike price of $45,000 expiring at the end of December and simultaneously purchase a call with the same strike price expiring in January (a calendar spread). This approach is considered prudent for maintaining exposure to potential price increases.

🚀BREAKING: Up +101% in 6 weeks – what is happening?

Summary: Ten weeks ago, we suggested that Bitcoin mining stocks could be the ultimate bet for 2024. Since then, those stocks have rallied by 60-80%. Six weeks ago, we looked closer into Bitdeer. Today, the stock closed up +101% since we initially recommended it when it traded at $3.1. Bitdeer mined 403 Bitcoins in November 2023 (worth $18m at today’s prices, or $215m annualized), up +81.5% YoY, with the number of mining machines mining Bitcoin up +44%.