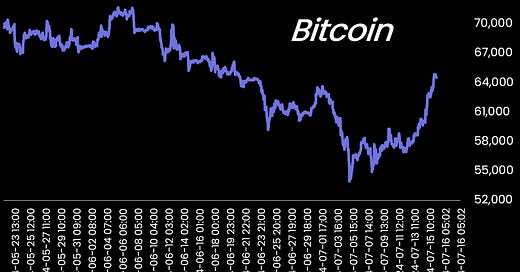

👇1-12) Often swayed by changing narratives, rumors, and speculation, Bitcoin can rapidly adjust its value based on new information. Since this past Friday, Bitcoin has surged by a significant 10%. What initially seemed like an oversold rally evolved into a breakout from a clearly defined downward trend. Our key level—bearish below 61,133 and bullish above—was surpassed, signaling a shift in market sentiment from bearish to bullish.

Here are the 10 key reasons behind this surge:

👇2-12) Retail Trading and Weekend Rallies: Weekend rallies are often fueled by retail trading and hope. This past Monday, several positive factors sustained Bitcoin's momentum. Our trading signals alerted us to buy MakerDAO (+14.2%), AAVE (+3.4%), and Polkadot over the weekend.

👇3-12) Net Liquidity Inflows: After four weeks of net liquidity outflows totaling $8 billion, the crypto markets saw $3.3 billion in inflows last week. This influx, primarily from futures, stablecoins, and Bitcoin Spot ETFs, marked a positive trend change. Additionally, Tether reported minting $1 billion in USDT.